Credit score union cash market charges are fluctuating, impacting your financial savings. This complete information explores the present tendencies, components influencing them, and accessible account choices. Understanding these charges is essential for maximizing your returns and securing your monetary future.

We’ll analyze latest tendencies, evaluating present charges to earlier durations. Elements like inflation, central financial institution insurance policies, and market forces can be examined. Totally different account sorts and their professionals and cons can be detailed, serving to you select the most effective match to your wants. Lastly, we’ll look forward at potential future tendencies, arming you with the data to make knowledgeable selections about your financial savings.

Present Cash Market Fee Tendencies

Cash market charges at credit score unions are experiencing dynamic shifts, influenced by a fancy interaction of things. Understanding these tendencies is essential for people and companies searching for optimum returns on their deposits. This evaluation delves into latest actions, evaluating them to historic knowledge, and explores the driving forces behind these adjustments.

Latest Tendencies in Credit score Union Cash Market Charges

Latest tendencies point out a fluctuating atmosphere in credit score union cash market charges. Whereas some credit score unions have seen slight will increase, others have remained comparatively steady and even skilled minor declines. This variability underscores the necessity for cautious comparability buying throughout completely different establishments.

Comparability to Earlier Quarters/Years

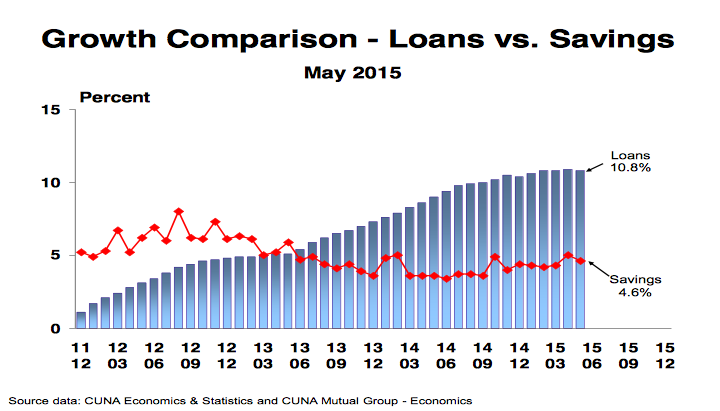

Evaluating present charges to these of the earlier quarters and years reveals a blended image. Some durations present substantial will increase in charges, whereas others present stability and even slight decreases. The general pattern is characterised by volatility, requiring people to intently monitor adjustments over time.

Elements Influencing Latest Fee Adjustments

A number of components contribute to the fluctuations in credit score union cash market charges. These embody, however should not restricted to, adjustments in total market rates of interest, inflation ranges, and the credit score union’s particular lending and funding methods. Central financial institution insurance policies additionally play a big function in influencing these charges.

Whereas credit score union cash market charges are sometimes aggressive, understanding if Plymouth Rock is a good insurance coverage supplier is essential for knowledgeable monetary selections. Elements like customer support, declare processing, and total worth ought to be fastidiously weighed earlier than deciding on an insurance coverage firm, like is plymouth rock a good insurance company. In the end, the most effective credit score union cash market charges nonetheless rely upon particular person wants and circumstances.

Present Cash Market Charges

The next desk presents a snapshot of present cash market charges from numerous credit score unions. Observe that charges are topic to alter and fluctuate based mostly on deposit quantities.

Credit score union cash market charges are at present enticing, providing probably greater returns than conventional financial savings accounts. Nevertheless, weighing the professionals and cons of shelter insurance coverage, particularly to your explicit wants, is essential earlier than committing to a coverage. Is shelter insurance good for you? In the end, understanding your particular dangers and evaluating charges from numerous suppliers is essential when deciding on credit score union cash market charges.

| Credit score Union Identify | Fee | Deposit Quantity |

|---|---|---|

| First Group Credit score Union | 0.50% | $10,000 |

| Second State CU | 0.45% | $5,000 |

| Third Federal Credit score Union | 0.55% | $25,000 |

| Summit Financial savings CU | 0.48% | $1,000 |

| Valley View Credit score Union | 0.52% | $100,000 |

Elements Affecting Cash Market Charges

Cash market charges, essential for short-term investments and borrowing, are dynamic and influenced by a fancy interaction of financial forces. Understanding these components is important for buyers and companies alike to make knowledgeable selections. These charges are always shifting in response to market circumstances and central financial institution insurance policies.

Impression of Inflation on Credit score Union Cash Market Charges

Inflation, the sustained enhance within the common worth stage of products and companies, immediately impacts cash market charges. When inflation rises, the buying energy of cash decreases. To counteract this, central banks usually enhance rates of interest. This, in flip, influences credit score union cash market charges, making them extra enticing for savers and probably growing borrowing prices for companies and shoppers.

Larger inflation usually results in greater cash market charges, as monetary establishments modify to keep up the actual worth of their belongings. For instance, if inflation surges, credit score unions will doubtless elevate their cash market deposit charges to compensate for the erosion of buying energy.

Position of Central Financial institution Curiosity Fee Insurance policies

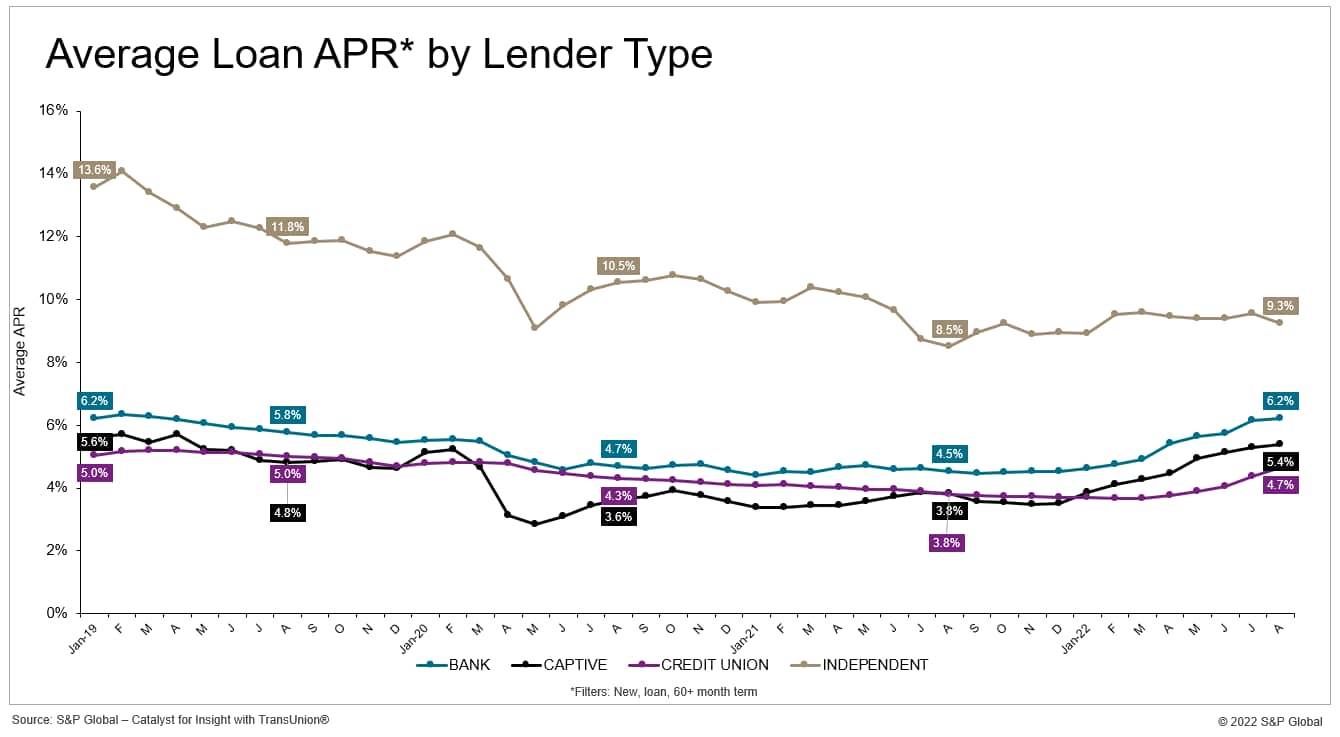

Central financial institution rate of interest insurance policies, akin to these set by the Federal Reserve in the US, play a big function in shaping cash market charges. Adjustments within the central financial institution’s benchmark rate of interest immediately have an effect on the price of borrowing for banks. This, in flip, filters right down to affect credit score union cash market charges. When the central financial institution raises its coverage charge, borrowing turns into dearer for banks, which regularly results in a corresponding enhance in cash market charges provided to depositors.

Conversely, decrease central financial institution charges normally translate to decrease cash market charges.

Affect of Market Provide and Demand

The interaction of provide and demand within the cash market additionally considerably impacts charges. If the demand for cash market accounts exceeds the provision, charges are inclined to rise. Conversely, if the provision of funds out there exceeds demand, charges could fall. This dynamic is influenced by numerous components, together with investor sentiment, financial outlook, and the general well being of the monetary market.

As an example, in periods of excessive uncertainty, buyers may search security in cash market accounts, growing demand and pushing charges upward.

Desk of Elements Impacting Cash Market Charges

| Issue | Impact on Cash Market Charges |

|---|---|

| Inflation | Larger inflation usually results in greater charges. |

| Central Financial institution Coverage Charges | Adjustments in central financial institution charges immediately affect credit score union charges. |

| Market Provide and Demand | Excessive demand, low provide results in greater charges; low demand, excessive provide results in decrease charges. |

| Financial Development | Sturdy financial progress usually correlates with greater charges. |

| Investor Sentiment | Investor confidence and danger urge for food can have an effect on the provision and demand for cash market accounts. |

Potential Future Tendencies in Curiosity Charges

Forecasting future rates of interest is complicated and entails analyzing a number of financial indicators. Present financial knowledge, together with inflation figures, employment reviews, and GDP progress, will play an important function in shaping future tendencies. For instance, if inflation stays persistently excessive, central banks may proceed to boost charges to curb worth will increase. Conversely, a slowing financial system may immediate central banks to decrease charges to stimulate financial exercise.

It’s essential to do not forget that any predictions about future rates of interest are estimates, and precise outcomes can differ.

Credit score Union Cash Market Account Choices: Credit score Union Cash Market Charges

Credit score unions provide a spread of cash market accounts designed to supply aggressive returns whereas sustaining accessibility. Understanding the different sorts and options is essential for maximizing the potential of those accounts. Selecting the best account will depend on particular person monetary objectives and danger tolerance.

Understanding credit score union cash market charges is essential for maximizing returns. Nevertheless, should you’re trying to change playing cards, realizing methods to shut an American Categorical card can be important. This guide will stroll you thru the method. In the end, savvy monetary selections, like understanding credit score union cash market charges, are key to your total monetary well being.

Kinds of Cash Market Accounts

Credit score unions typically present a number of cash market account choices, every tailor-made to particular wants. These accounts usually provide greater rates of interest in comparison with normal financial savings accounts, however could have minimal steadiness necessities. Key distinctions usually lie in options like withdrawal restrictions, related charges, and the extent of liquidity.

Key Options and Advantages Comparability

Analyzing the options and advantages of various cash market accounts is important for knowledgeable decision-making. Contemplate components just like the minimal deposit required, the prevailing rate of interest, any related charges, and the flexibleness of entry to funds.

| Account Sort | Minimal Deposit | Curiosity Fee (Instance) | Charges (if any) | Withdrawal Restrictions |

|---|---|---|---|---|

| Excessive-Yield Cash Market | $1,000 | 0.50% APY | Month-to-month upkeep payment of $5 | Restricted withdrawals monthly |

| Fundamental Cash Market | $500 | 0.25% APY | No charges | Limitless withdrawals |

| Youth Cash Market | $0 | 0.10% APY | No charges | Limitless withdrawals (with parental consent the place relevant) |

Particular Credit score Union Cash Market Accounts

A number of credit score unions provide enticing cash market accounts with various rates of interest and options. As an example, a selected credit score union may present a “Development Saver” account with a aggressive rate of interest for people searching for greater returns, or a “Safe Financial savings” account with a decrease minimal steadiness and fewer restrictions for frequent entry. Check with your credit score union’s particular choices for particulars on account specs.

Professionals and Cons of Investing in Credit score Union Cash Market Accounts, Credit score union cash market charges

Understanding the benefits and downsides of investing in credit score union cash market accounts is essential for a sound monetary technique. Contemplate the potential for greater returns in comparison with conventional financial savings accounts, together with potential restrictions on entry and related charges.

- Professionals: Usually greater rates of interest than financial savings accounts, FDIC insured, probably aggressive charges in comparison with different establishments.

- Cons: Minimal steadiness necessities could apply, charges is likely to be related to sure accounts, restricted entry to funds is likely to be a difficulty for some account sorts.

Remaining Wrap-Up

In conclusion, credit score union cash market charges provide a various vary of choices for maximizing financial savings. Understanding the present tendencies, influencing components, and account sorts empowers you to make knowledgeable monetary selections. By evaluating charges and contemplating your particular person wants, you’ll be able to safe the absolute best returns in your financial savings. The insights offered on this information will aid you navigate the present market and plan for the longer term.

In the end, you are empowered to make good selections and construct a safe monetary future.

FAQ Overview

What are the everyday charges related to credit score union cash market accounts?

Most credit score unions provide cash market accounts with no month-to-month upkeep charges. Nevertheless, some may cost charges for inadequate funds or different particular transactions. At all times evaluate the particular phrases and circumstances of every account to keep away from surprises.

How do credit score union cash market charges evaluate to charges provided by banks?

Credit score unions usually provide aggressive, typically higher, charges than banks. Nevertheless, the most effective comparability entails analyzing particular account particulars, together with minimal deposit necessities, rates of interest, and charges. Comparability buying is important.

What’s the typical minimal deposit requirement for credit score union cash market accounts?

Minimal deposit necessities fluctuate considerably between credit score unions. Some could require a low preliminary deposit, whereas others could have greater thresholds. This ought to be fastidiously thought-about based mostly in your monetary state of affairs and funding objectives.

What’s the impression of a rising rate of interest atmosphere on credit score union cash market charges?

A rising rate of interest atmosphere usually results in greater cash market charges at credit score unions. Nevertheless, the extent of the rise will depend on numerous market components and the particular credit score union’s lending and deposit methods.